Press Release

Wild catch up by 169%, farmed down by 0.8% as farmed industry faces headwinds

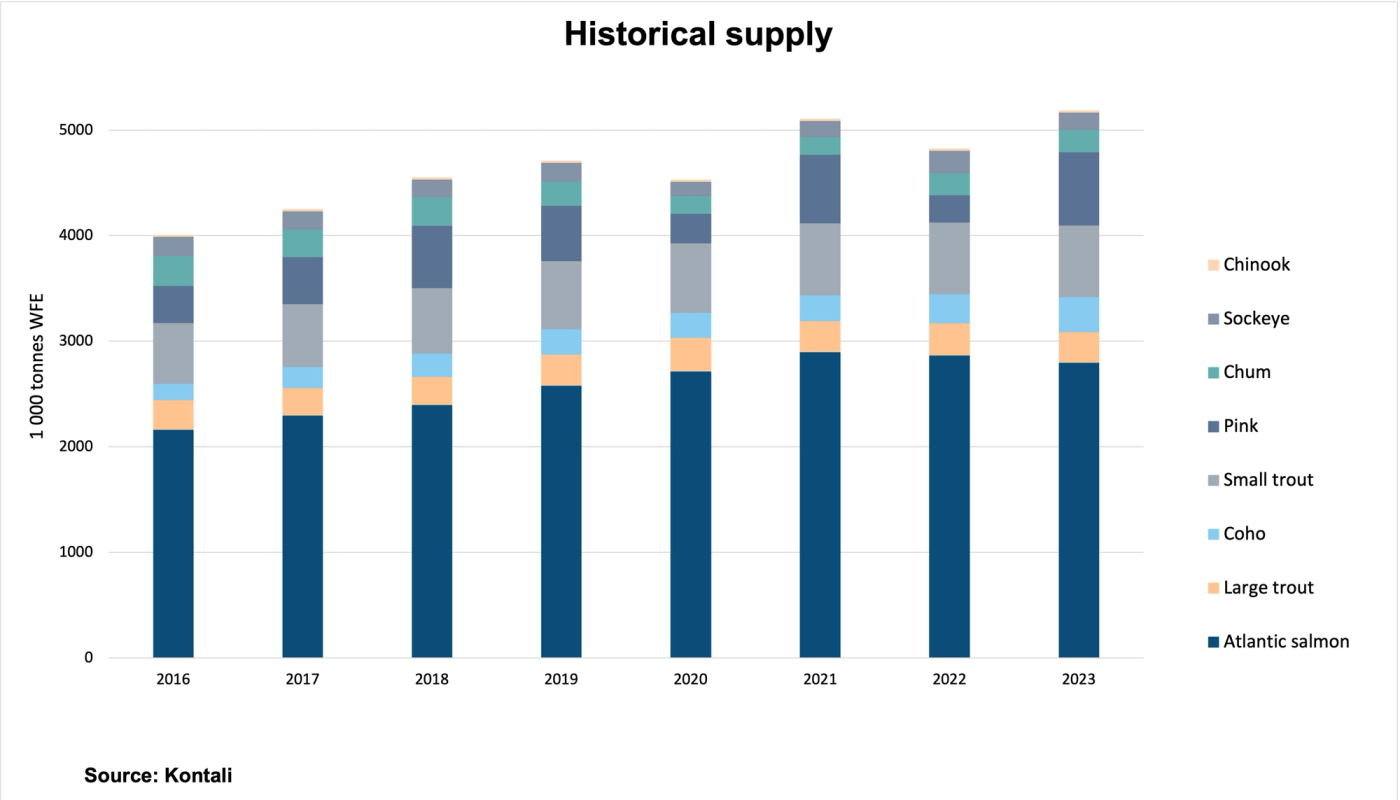

Driven by a robust wild catch season, the total supply of salmonids, including small trout, increased by 7% year-over-year (YoY) to 5.2 million tonnes in 2023, according to Kontali analysis.

The increase in the wild catch segment was primarily driven by pink salmon, which reached 690,000 tonnes, up 169% YoY. In contrast, farmed salmonid supply remained relatively stable, with a slight decrease of 0.8% YoY. Kontali's research indicates that the top 15 salmon-farming companies accounted for 66% of global salmon-farming harvest volumes in 2023. MOWI maintained its position as the largest player, holding a 15% share of total farmed salmonid volumes, unchanged from 2022.

In the Atlantic salmon sector, harvest volumes decreased for the second consecutive year, dropping by 2% YoY to 2.79 million tonnes in 2023. Norway, the largest producer, saw a 2.5% decline to 1.48 million tonnes. In contrast, Chile increased its production by 2% to 760,000 tonnes. Canada experienced the largest production decline, down 17% YoY, whereas Russia recorded a 9% increase, signalling a recovery post-sanctions. Global production of large trout decreased by 6% YoY to 289,800 tonnes, with Chile experiencing a significant 28% decline. However, farmed coho salmonid production globally surged by 18% YoY to 309,000 tonnes, driven by a substantial increase in Chile.

“The challenges in 2023 are hanging over the industry and impacting 2024. Despite efforts to address these issues, 2024 began with low biomass, and the limited growth from 2023 further reduces harvest potential this year. While land-based production has shown promise, it is still in its early stages and hasn't significantly impacted global salmon production,” says Filip Szczesny, senior analyst, Kontali.

Atlantic salmon exports to the USA market stagnated in 2023 after seven years of continuous growth. In the largest market for Atlantic salmon, the EU + UK market, supply decreased by nearly 5% YoY to 1.2 million tonnes. The Japanese market continued to decline, down 19% YoY, while the Russian market recovered, from a close to historic low level.

Total wild-caught species amounted to 1.09 million tonnes, a 57% increase YoY. However, prices moved in the opposite direction. For example, average prices for Alaskan sockeye dropped by 49% YoY despite a 22% decrease in catch volume.

About Kontali:

Kontali is a leading provider of data, analysis, and insight into the global aquaculture and fisheries sectors. With decades of experience, Kontali is dedicated to delivering high-quality information that helps stakeholders make informed decisions in a rapidly changing market.

Victor Ponsford

Kontali, communications

+47 94974977