Press Release

Volatility on the horizon: Salmon prices expected to decline marginally amid increased production.

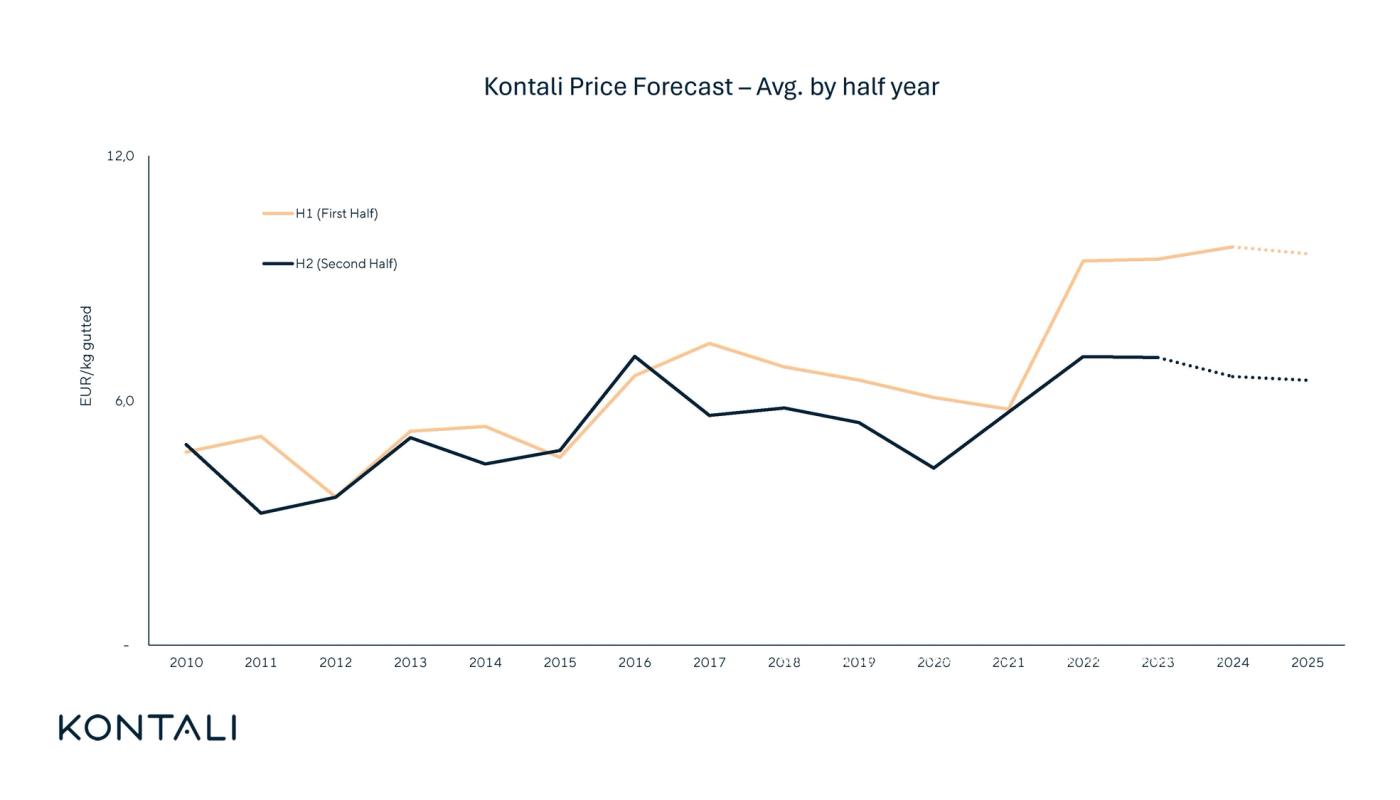

Salmon production is forecast to grow by 3.5-4.0% in 2025, resulting in a slight decline in spot prices for the full year, according to the latest research from Kontali. This growth is driven largely by a recovery in Norwegian and European productivity. Furthermore, the difference in price achievement between the first and second half of 2025 is expected to be around EUR 3 per kg.

In terms of volume for 2025, Norway’s will increase by at least 40,000 tonnes Whole Fish Equivalent (WFE) and the rest of Europe by at least 35,000 tonnes WFE. This projection for 2025 comes on top of an increase in harvest volumes for 2024 (+5% YoY) for Faroe Islands, Iceland, Norway, and the United Kingdom. Demand from high-value foodservice segments such as sushi restaurants in Europe, North America, and Asia (China and Hong Kong) has recovered strongly following the COVID-19 pandemic and continue to support high prices in the first half of 2025.

However, the regulatory regime (maximum allowable biomass) and sea temperatures will determine final production levels. Closer to 60% of global volume is expected to be harvested and sold in the second half of 2025, with retail as the primary end-sales channel to consumers. For producers, value growth in 2025 is anticipated to be driven by increased volumes, particularly through retail promotions and campaigns for farmed salmon, rather than higher spot prices.

“Farmed salmon has become a very popular food staple, but salmon prices downstream in the supply chain must remain competitive against beef, pork, and poultry. Looking ahead, supply in the first half of the year is expected to once again face a seasonal shortage. In the second half of the year, as supply improves, a stronger focus on retail promotions and campaigns is expected. As production picks up, promotional activities and contracts will nevertheless not balance out the excess volumes in the spot market at ‘spring prices,’ so a notable price drop is forecasted,” says Lars Daniel Garshol, Lead Analyst, Salmonids at Kontali.

Kontali’s forecast indicates that increased production and improved conditions will drive volume growth and prices are likely to decline as a result. This sets the scene for a more competitive and potentially volatile market. Market participants will need to consider how best to navigate this new volatility in the market. Producers are expected to hedge by increasing the share of contracts with retail buyers, but spot availability in Europe may still be attractive, especially considering anticipated significant price differences between the first and second halves of 2025. However, an improved macroeconomic environment, with declining inflation and rising consumer purchasing power, could help balance downward pressure on prices by boosting demand in key markets.

Lars Daniel Garshol

Lead Analyst, Salmonids

[email protected] (mailto:[email protected])

Victor Ponsford

Press relations

[email protected] (mailto:[email protected])

+47 94974977

About Kontali:

Kontali is a leading provider of data, analysis, and insight into the global aquaculture and fisheries sectors. With decades of experience, Kontali is dedicated to delivering high-quality information that helps stakeholders make informed decisions in a rapidly changing market.